cash app venmo tax

If you make more than 600 through digital payment apps in 2022 it will be. For the 2022 tax year you should consider the amounts shown on your 1099-K when calculating gross receipts for your income tax return PayPal warns.

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You 6abc Philadelphia

Cash App Taxes is a free online tax preparation service within the application where you can file your federal and state taxes.

. CashApps comments on a TikTok warning users about the tax amount. Find out if you need to upgrade to the business account whether your personal transactions have any tax consequences and the reason why Cash Apps like Venmo hold your. The IRS will be able.

However in January the threshold is being reduced dramatically from 20000 to 600 with no minimum number of transactions Rosenthal says. Keep in mind that the IRS. Cash App Taxes makes no guarantee over when refunds are sent by the IRS or states and funds can be made available.

As of Jan. Payment apps like PayPal Venmo and Zelle are a convenient way to send and receive money without paying cash waiting for a check to clear or making a trip to the bank to. This new rule applies to paying cash app taxes including on income received through PayPal Venmo Cash App and most third-party payment networks.

The cash app facilitates debit cards tax refunds free money transfers and Investment in stocks and Bitcoin. Instead it only pertains to Cash for Business accounts and. Cash App charges businesses a 25 fee per transaction accepted and a 275 fee when accepting credit card payments.

At this time Zelle. Event7000 I have sahlt. Cash App Taxes.

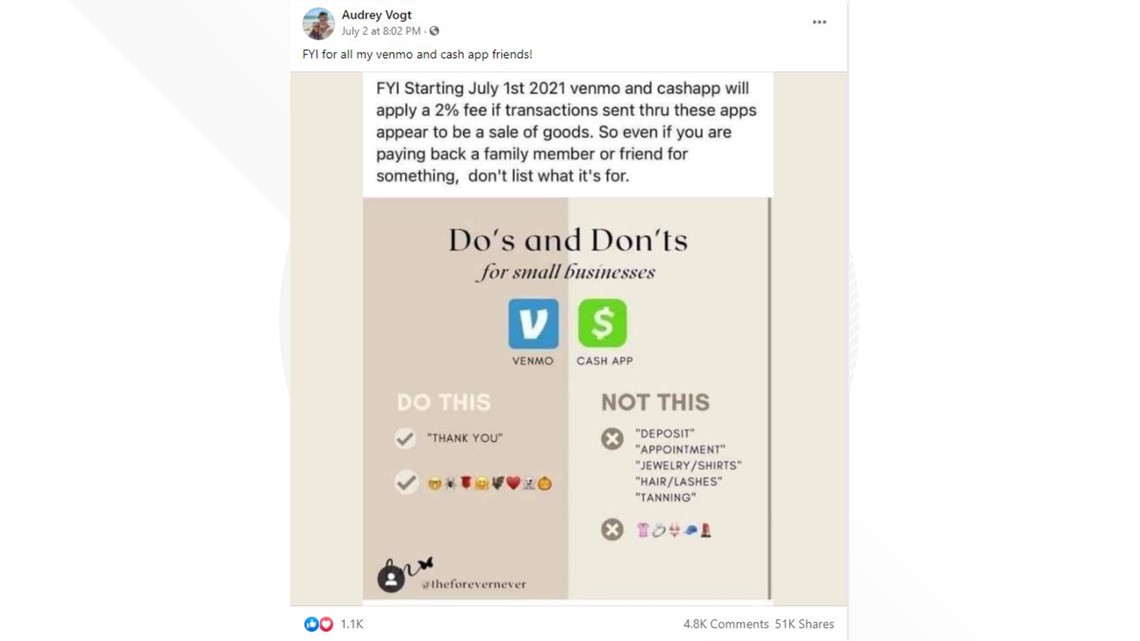

But users were largely mistaken to believe the change applied to them. Fact or Fiction. The IRS is cracking down on the apps to make.

Third-party payment processors like Venmo PayPal and Cash App are now required to report a users business transaction to the IRS if they exceed 600 for the year. This is due to the new tax reporting requirement put on third-party settlement organizations TPSOs such as PayPal and Cash App as part of the American Rescue Plan Act. Coco Bliss UPDATED Dropbox 200 pics 30 vids SEXTAPE and 2 minute FINGERING VID INCLUDED 10 Cash App Venmo or PayPal Anyone Interested.

Youll Owe Taxes on Money Earned Through PayPal Cash App and Venmo This Year. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue. There are tax implications attached to Cash App.

5 day refund estimate is based on filing data from 2020. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal. Signing up for an account is.

On it the company notes this new 600 reporting requirement does not apply to personal Cash App accounts. The downside of the cash app is that the FDIC. Payments of 600 or more through third-party payment networks like Venmo Cash App or Zelle will now be reported to the IRS.

1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service. As stated in the comments a user may only receive a 1099-K form if they.

New Law Impacting Peer To Peer Payment App Users

New Irs Tax Rules Will Affect Cash App Users What You Need To Kn Wcnc Com

3 Ways To Avoid Taxes On Cashapp Venmo Paypal Zelle Legally Youtube

How Does The Irs Law Work On 600 Payments Through Apps Marca

Tip Jar Qr Code Payment Sign For Paypal Venmo Cash App Zelle Touch Free Ebay

Fact Or Fiction Could We Soon Owe Taxes On Venmo Payments

Irs To Crack Down On Tax Reporting From Venmo Paypal And Cash App

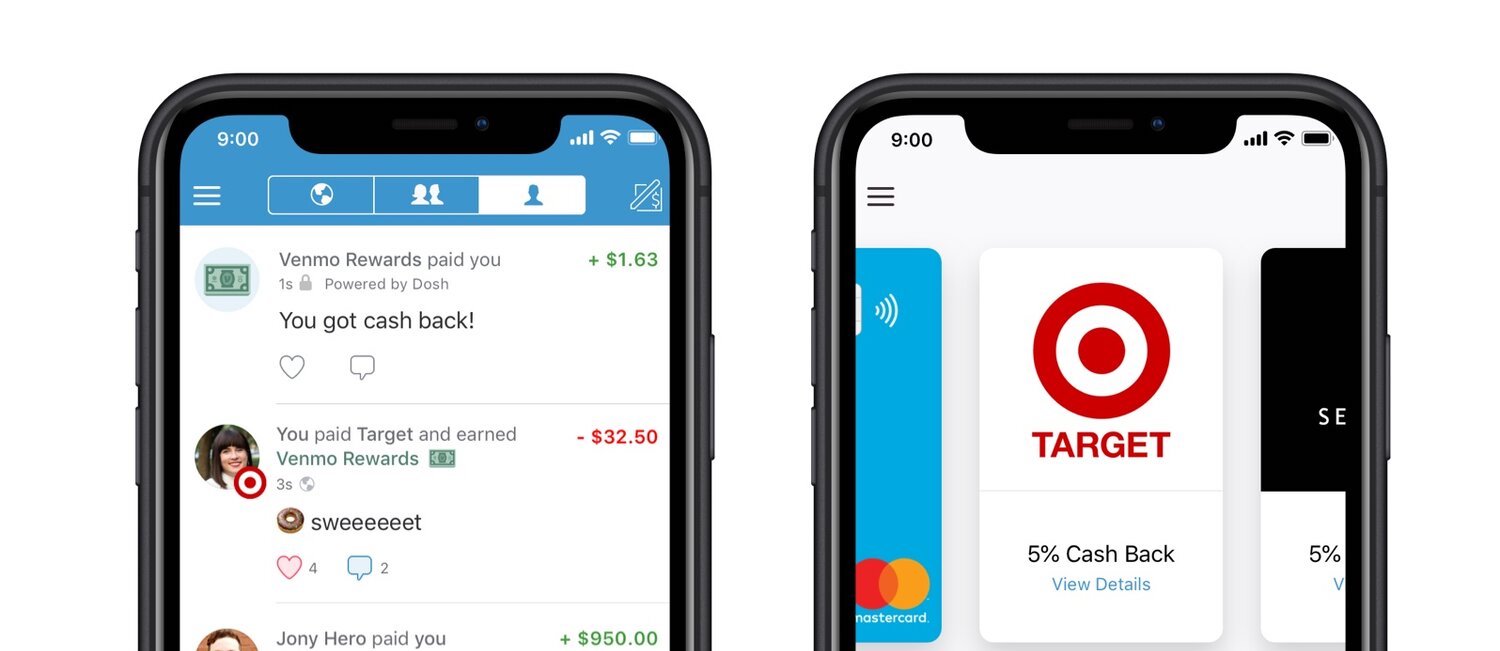

Venmo Is Copying Yet Another Cash App Feature The Motley Fool

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com

Tas Tax Tip Use Caution When Paying Or Receiving Payments From Friends Or Family Members Using Cash Payment Apps Tas

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Everything To Know About Venmo Cash App And Zelle Money

What S New For Family Child Care Providers Who Use Electronic Payment Apps Taking Care Of Business

There S A New Tax Rule For Us Small Business Owners What To Make Of It Us Small Business The Guardian

Paypal Venmo Cash App And Most Payment Apps To Report Payments Of 600 Or More

Venmo Taxes Does I Have To Pay Taxes On Venmo Transactions

Venmo Will Have New Service Fees But You Have To Opt In Verifythis Com

Eyewitness News On Twitter Heads Up If You Use Payment Apps Like Venmo Paypal Or Cashapp The New Year Ushered In A Change To An Irs Tax Reporting Rule That Could

Getting Paid On Venmo Or Cash App There S A Tax For That Los Angeles Times